Think tank urges governments to make TNFD reporting mandatory

UK think tank Green Alliance has highlighted a number of policy mechanisms needed to unlock financial flows for nature preservation and restoration – one of which is making nature disclosures through TNFD mandatory.

Turning voluntary disclosure frameworks into law has been observed in the climate realm, with over 30 jurisdictions in the process of integrating the ISSB reporting standard – derived from the work of the TNFD’s now defunct older sister, the Taskforce on Climate-related Financial Disclosures or TCFD – into mandatory corporate reporting.

Now, Green Alliance argues that turning the TNFD (Taskforce on Nature-related Financial Disclosures) into a mandatory reporting framework would incentivise voluntary action by forcing companies to assess their impacts on biodiversity. (More than 500 companies have already committed to doing so voluntarily.)

This would then allow them to invest in nature restoration,” either to enhance their reputation with customers or because they recognise the material risks to their business of not doing so”, the think tank suggests. They might even want to purchase nature or biodiversity credits to begin to compensate for their impacts..

In setting nature targets, companies can draw from the work of the Science Based Targets Network (SBTN), which was recently deemed by WWF as “sufficiently mature” to guide widespread corporate nature action.

Join CSO Futures’ free webinar on nature strategy on November 26 to get expert advice on how to assess impacts and convince boards of the importance of nature action for business: Click here to register.

Mandatory nature investment for construction and food sectors

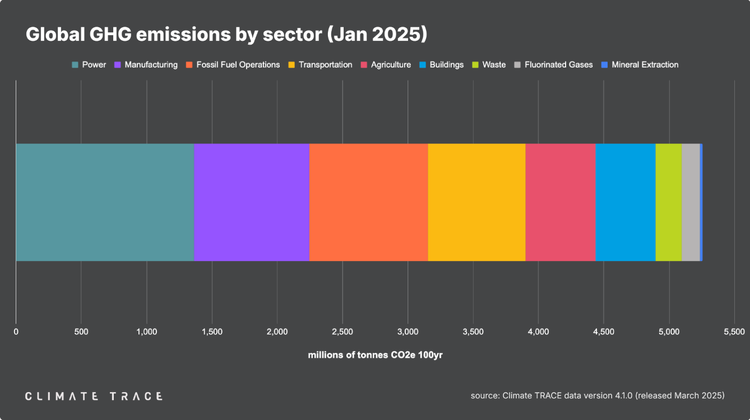

At a later stage, Green Alliance believes governments should create the infrastructure for compliance nature credit markets, therefore requiring businesses in certain sectors to invest in nature restoration – under the same logic as the EU emissions trading system for GHG emissions.

In fact, the think tank states that existing compliance markets, for example the Biodiversity Net Gain market for construction in the UK, could be expanded to cover wider environmental gains, while new markets could be created for other sectors, such as the food industry.

“Building housing and infrastructure has a direct impact on nature on land and in water, so mitigating those impacts is an obvious place to start. However, the sector with the largest impact is food, with over 60% of land in England used for agriculture,” Green Alliance notes.

Changing company incentives to spur nature action

In the end, though, the think tank explains that attention should be paid to the top of the mitigation hierarchy, ie. avoiding nature impacts in the first place, by expanding the legal responsibilities of company directors (fiduciary duties) to include the protection of nature.

“This would require businesses to consider nature as a stakeholder impacted by company activities, as an incentive to invest in its protection,” the report’s authors argue.

Member discussion