Singtel expands internal carbon pricing after successful trial

Singapore telco Singtel is expanding its internal carbon pricing policy after a pilot demonstrated the mechanism’s effectiveness in incentivising investment in low-carbon projects.

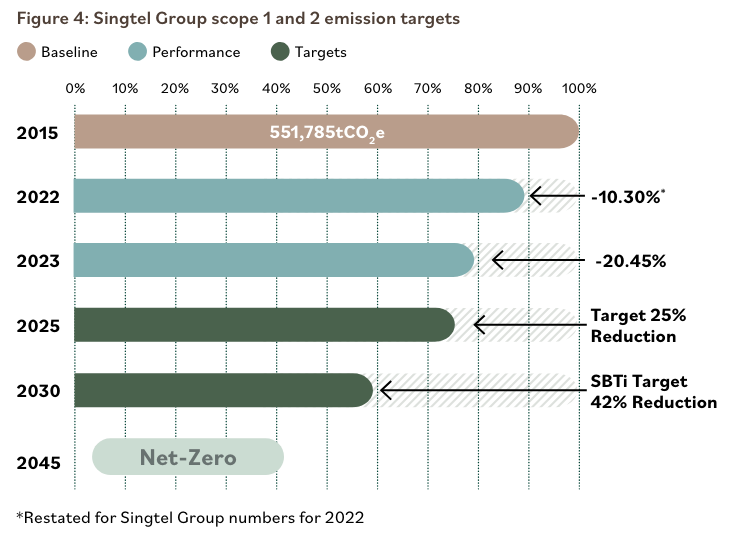

The company, which reported a 64% drop in net profits in FY2024, is stepping up its game to meet its SBTi-approved net zero goal across the value chain by 2045, including by upgrading its 2030 carbon reduction goals from 42% to 55% for operational emissions and from 30% to 40% for Scope 3.

As part of the process, in 2022 Singtel piloted the application of an internal carbon price (ICP) – a mechanism through which companies self-impose a type of carbon tax for each tonne of CO2 a project emits, generally using the proceeds to finance sustainability measures – on four energy-intensive projects.

In its 2023 sustainability report, the firm gives the example of applying the shadow price to the tender process for an IT tool to generate quotations for orders: “Each tenderer was evaluated on their emissions calculated using their company emission factors. The shadow price was then applied to arrive at a holistic cost of ownership, which imputed the total environmental impact as cost associated with using this tool for this particular business activity.”

Singtel pricing carbon at US$37 per tonne

Now, the company has announced that it will expand its ICP initiative, reportedly for all CAPEX projects emitting more than 100 tonnes of CO2 in their lifetime – up from a previously announced 1,000-tonne threshold – meaning all new infrastructure and equipment investments will likely be covered.

Singtel is pricing carbon at S$50 (US$37) per tonne of CO2 equivalent – lower than the US$40 to US$80 per tonne recommended by the Carbon Pricing Leadership Coalition for 2020, but higher than Asian peers in this sector.

Speaking to Eco-Business, Singtel Group Chief People and Sustainability Officer Aileen Tan explained that the ICP is part of “a very pragmatic approach” to decouple business growth from emissions, getting rid of legacy equipment and incentivising low-carbon opportunities.

‘A pragmatic approach’ to reducing emissions

Internal carbon pricing is one of several financial instruments Singtel is deploying to meet sustainability objectives: in 2023, the company also issued a US$100 million digital sustainability-linked bond and signed a S$500 million (US$370 million) sustainability-linked revolving credit facility, while its Australian subsidiary Optus signed a A$1.4 billion (US$925 million) sustainability-linked revolving credit facility – the first by an Australian telco.

The same year, the firm’s carbon footprint decreased by more than 53%, with reductions across all scopes. For Scope 3, the drop was largely due to changes in Singtel’s accounting method, but an 11% reduction in operational emissions was achieved through energy efficiency initiatives, hybrid work and the retirement of Renewable Energy Certificates (RECs).

Internal carbon pricing is an increasingly popular tool used by companies to align sustainability and financial goals. According to CDP data, the number of companies embedding an internal carbon price into their business strategies grew from 150 in 2014 to over 850 in 2020.

Member discussion