Scaling regenerative agriculture: Mars, McDonalds, Waitrose say a new blueprint could be the key to unlocking an intractable problem

Some of the world’s biggest food buyers have teamed up to share a new regenerative agriculture blueprint that they say could unlock “trillions” of value and help resolve a seemingly intractable problem: That shifting to more sustainable farming at scale is hugely expensive and nobody wants to foot the bill.

Bayer, Mars, McCain Foods, McDonald’s, Mondelez, PepsiCo and Waitrose are among the members of the Sustainable Markets Initiative Agribusiness Task Force, which has been exploring ways to tap more sustainable forms of agricultural production – from Basmati rice in India, potatoes in the UK, to wheat in the US.

Tackling that challenge is a pressing problem: The global food system currently creates an estimated ~30% of human-produced GHG emissions and is the greatest driver to nature loss – but the economics of transitioning to more sustainable production models simply “do not work for most farmers” the Task Force admits.

“Embracing regenerative farming globally could help provide a third of the land-based climate action needed by 2030” the Task Force said in a new implementation blueprint, based on research conducted throughout 2022 and 2023.

Scaling regenerative agriculture: 5 hurdles

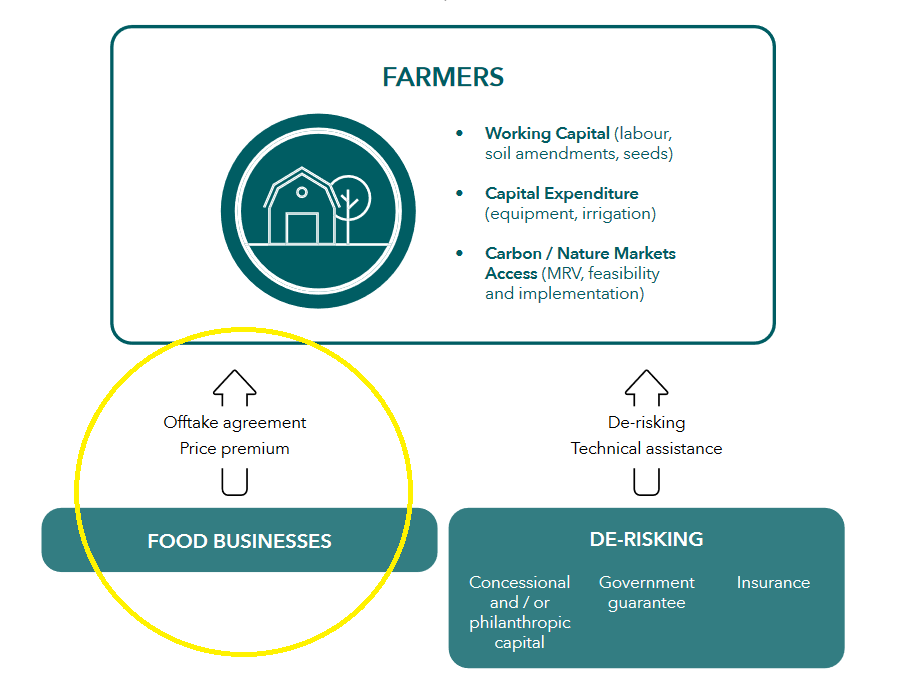

They are now proposing “coordinated monetisation” of five metrics across climate, soil, biodiversity, water and nitrogen – with farmers incentivised to deliver that change through blended finance packages that would include “philanthropic support, catalytic capital from asset managers, commercial capital offered at preferential rates from banks, longer-term contract commitments from food businesses to source sustainable commodities, and crop insurance.”

The actual "regenerative agriculture" metrics

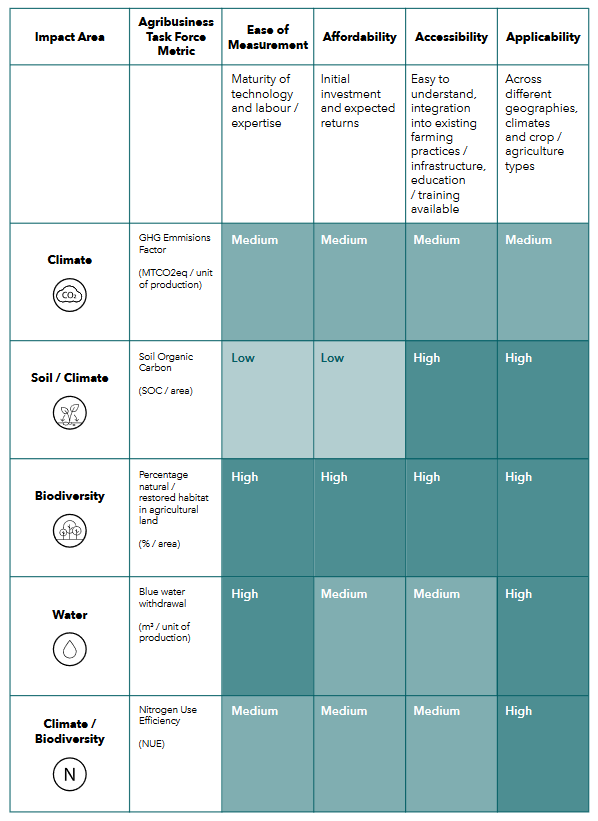

The Task Force said that it has settled on five key metrics for regenerative agriculture that align with the SAI Platform -- selected based on “importance, ease of deployment, current usage, ease of monetisation and breadth of applicability."

These are:

• Greenhouse gas (GHG) Emissions Factor (MTCO2eq / unit of production);

• Soil Organic Carbon (SOC / area);

• Percentage natural / restored habitat in agricultural land (% / area);

• Blue water withdrawal (m³ / unit of production);

• Nitrogen Use Efficiency (NUE)

The task force says there is five key hurdles to scaling regenerative agriculture/

- Costs: For farmers and for buyers

- Sourcing: To share transition costs across value chains

- Income: To help build farmers' income from environmental outcomes

- Policy: That rewards farmers for transitioning

- Metrics: Agree on common metrics to measure environmental outcomes

The first four of these ultimately boil down to “who pays” – but the companies recognise, candidly, that “For the farming transition to happen at scale, financial mechanisms must shift cost and risk of the transition away from the farmer.”

In its new “Blueprint for Implementation” the task force says it has identified a way “unlock many of the sticking points that have prevented regenerative farming from scaling faster” – including via a “priority funding, de-risking, and sourcing model [including] blended finance, technical assistance, loans, offtake agreement, price premium) that stakeholders can provide to transitioning farmers.”

The blueprint is welcome, but the devil is in the detail and, the Task Force admits, “how these ingredients are put together will depend on local context…”

Among the many interesting if still immature areas the blueprint touches on are Ecosystem Services Markets (ESM) – which it describes as holding “enormous potential to catalyse finance for the transition to regenerative agriculture” including via “high integrity carbon offsets and Scope 3 value chain reductions.”

To those for whom this all sounds highly nebulous, the Task Force said that in 2024 its goal will be to provide concrete evidence of the Blueprint for Implementation at work by “enabling and supporting partnerships among the different supply chain stakeholders” and will be exploring “at least four farming projects to prove its concept” in 2024 including one around rice production in India, involving Bayer and Olam; canola and wheat projects in Poland, involving Mars, PepsiCo and ADM; wheat projects in the US, involving Mondelez and Indigo AG; and potatoes and other crops in the UK, involving McCain, McDonald’s, Waitrose, PepsiCo, HSBC, Lloyds Banking Group and NatWest.

The report came the same week that the FAO noted that “despite an increase in global climate finance flows, support for agrifood systems lags behind other sectors, constituting less than 20% of climate-related development finance in 2021” with the FAO Director-General saying that a “loss and damage fund” set up on the first day of the UN Climate Change conference in Dubai “reaches the agricultural communities dealing on the frontlines of the climate crisis.”

Member discussion