Renewable energy carbon credits excluded from market integrity scheme

Carbon credits generated from renewable energy projects do not meet eligibility criteria to obtain the Integrity Council for the Voluntary Carbon Market’s (ICVCM) high-quality label.

The ICVCM announced today that carbon credits issued under existing renewable energy methodologies – which make up about a third of the voluntary carbon market – will not be able to use its high-integrity Core Carbon Principles (CCP).

The decision was made in an effort to “raise the bar” for carbon crediting from renewable energy projects, after an initial assessment suggested that these credits did not meet the CCP’s additionality requirements – meaning that it is not clear whether projects would go ahead without the incentive of carbon credit revenue.

Understanding additionality

One of the key elements in assessing the quality of a carbon project revolves around the concept of additionality. Put simply, a project is additional if it can demonstrate that it would not have gotten off the ground without the added funding provided by carbon credit sales. Most carbon credit standards include additionality assessments, but it’s important for companies to get familiar with their specific methods and criteria to ensure that carbon credit investments drive additional impact.

The declining popularity of renewable energy carbon credits

Renewable projects developers can generate carbon credits by calculating the emissions their solar, wind or hydropower plants would displace compared to an equivalent fossil fuel power plant.

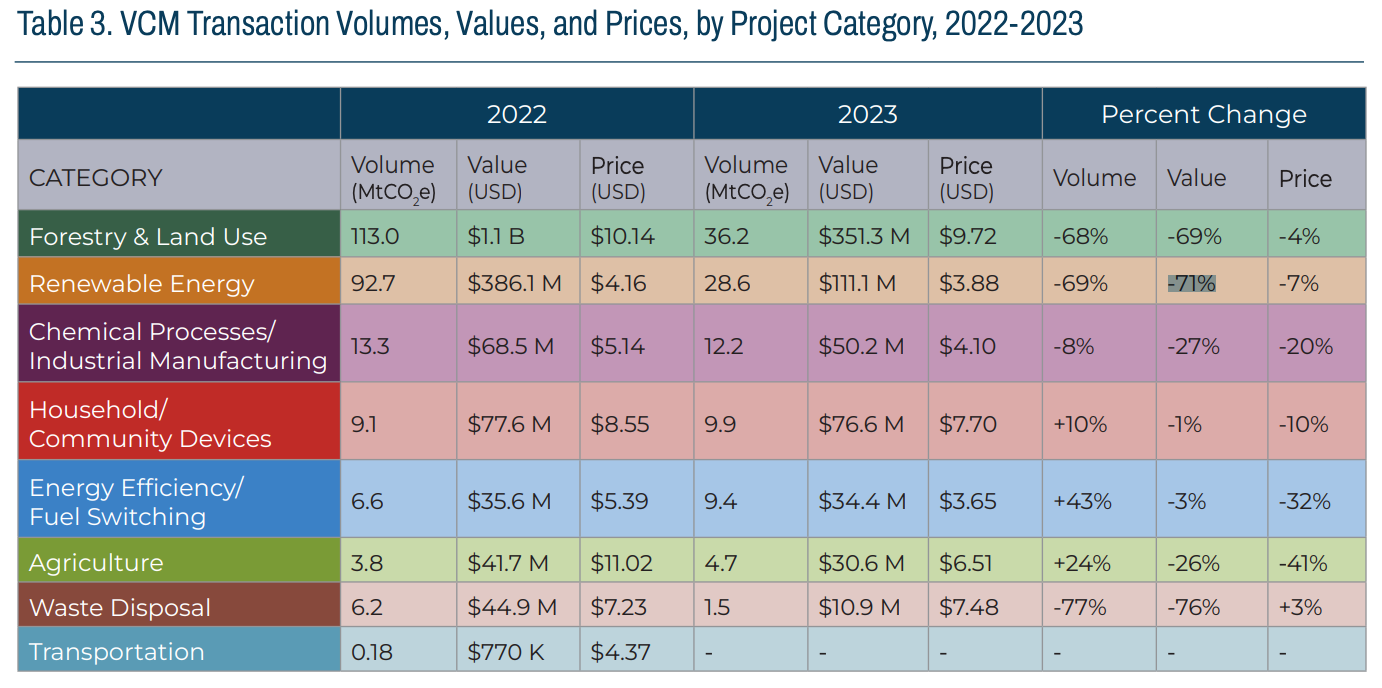

They are the second most popular type of carbon offsets after forestry and land use projects, but they have rapidly declined in both volume and value as increased scrutiny raised questions about their quality. In 2023, 28.6 million tonnes of renewable energy credits were sold on the voluntary carbon market, for a total of US$111.1 million – down 71% from the previous year.

Today, they represent approximately 236 million unretired credits, making up 32% of the voluntary carbon market, according to the ICVCM.

Annette Nazareth, Integrity Council Chair, said: “We are taking the tough decisions necessary to build a high-integrity voluntary carbon market that can be scaled to meaningfully fund climate solutions and channel material amounts of finance to the Global South. Renewable energy projects financed by carbon credits still have a role to play in the decarbonisation of energy grids because it remains challenging for many least developed countries to secure the investment they need to transition away from fossil fuels.

“However, we need to modernise the design of these carbon projects, which carbon- crediting programs can and should do. More robust methodologies would unlock finance for a new wave of renewable energy projects in places where they are most needed.”

CCP-eligible carbon credits now represent 3.6% of carbon market

The ICVCM’s Core Carbon Principles were launched last year as a set of quality criteria designed to build trust in the voluntary carbon market and ensure comparability of credits. Since then, the organisation has been assessing existing carbon credit generation methodologies’ eligibility under the scheme.

It approved seven of them in June, including landfill methane recovery and gas destruction, as well as ozone depleting substances destruction methods. Today, it also approved a methodology for projects that detect and repair methane leaks in the gas industry and another version of a previously approved methodology for projects that capture methane from landfill sites.

These take the total number of unretired credits approved to use the CCP label to an estimated 27 million – 3.6% of the market.

Amy Merrill, Integrity Council CEO, said: “Our rigorous, science-based assessments are well underway and will give buyers confidence that CCP-labelled carbon credits deliver genuine emissions reductions and bring positive social and environmental benefits that support Indigenous Peoples and local communities. These decisions will shape the development of the market and all participants will benefit over time, as CCP-labelled credits unlock greater investment flows and drive innovation.”

Other carbon offset categories under assessment

For carbon credits to bear the CCP label, both their carbon crediting programme (such as ACR, Climate Action Reserve, Gold Standard and Verra, all of which were approved by the ICVCM) and the methodology used to generate them have to be CCP-eligible.

The Council says it has also concluded its assessment of other important credit categories, including several methodologies for forest and land use credits, which have been the most controversial after several investigations found many of them “worthless”.

These assessments will soon be sent to the ICVCM Governing Board for decisions.

While renewable energy credits remain excluded from its high-integrity scheme for the time being, the organisation says it is ready to review more rigorous methodologies once they are developed.

“Following this decision, we encourage programs to develop methodologies that take a much more sophisticated approach to assessing whether renewable energy projects are additional. It would also be enormously beneficial for international agencies concerned with improving energy access for all to support this work and develop more reliable models and data sets to draw from,” said Pedro Martins Barata, Integrity Council Expert Panel Co-Chair.

Member discussion