One year left for EU banks to set up EBA-aligned ESG risk management

The European Banking Authority (EBA) will require large EU banks to identify and manage ESG risks, including climate transition risks, by January 11, 2026.

In its newly-published ‘Guidelines on the management of ESG risks’, the EU’s banking authority lays out the scope, compliance requirements and specific rules for banks to manage their environmental, social and governance (ESG) risks.

By January 11, 2026, large European banks have to set up processes to conduct a robust materiality assessment of ESG risks – specifically financial risks derived from new ESG-related trends and regulations for all the sectors they serve.

The guidelines provide more details on the assessment of climate-related risks: for instance, banks should assess their exposure to sectors that contribute highly to climate change (particularly fossil fuels) and their portfolios’ potential misalignment with jurisdictional climate goals such as nationally determined contributions (NDCs).

They should also assess physical climate risks, based on the location of their own real estate, as well as their clients’ key assets.

Overcoming data challenges

Based on their materiality assessment, financial institutions will be required to develop and implement measurement methods, risk management arrangements and transition planning processes.

Noting that reliable data may initially be lacking in certain areas, the EBA advises that banks’ internal procedures “should provide for methods that start by evaluating qualitatively the potential impacts of these risks on the operations of, and financial risks faced by, the institution, and should progressively develop more advanced qualitative and quantitative measures”.

The authority adds that ESG risk assessment approaches should gradually evolve alongside regulatory, scientific, data availability and methodological progress. In the meantime, financial institutions can and should enrich their own data with external information obtained from clients and third-party providers.

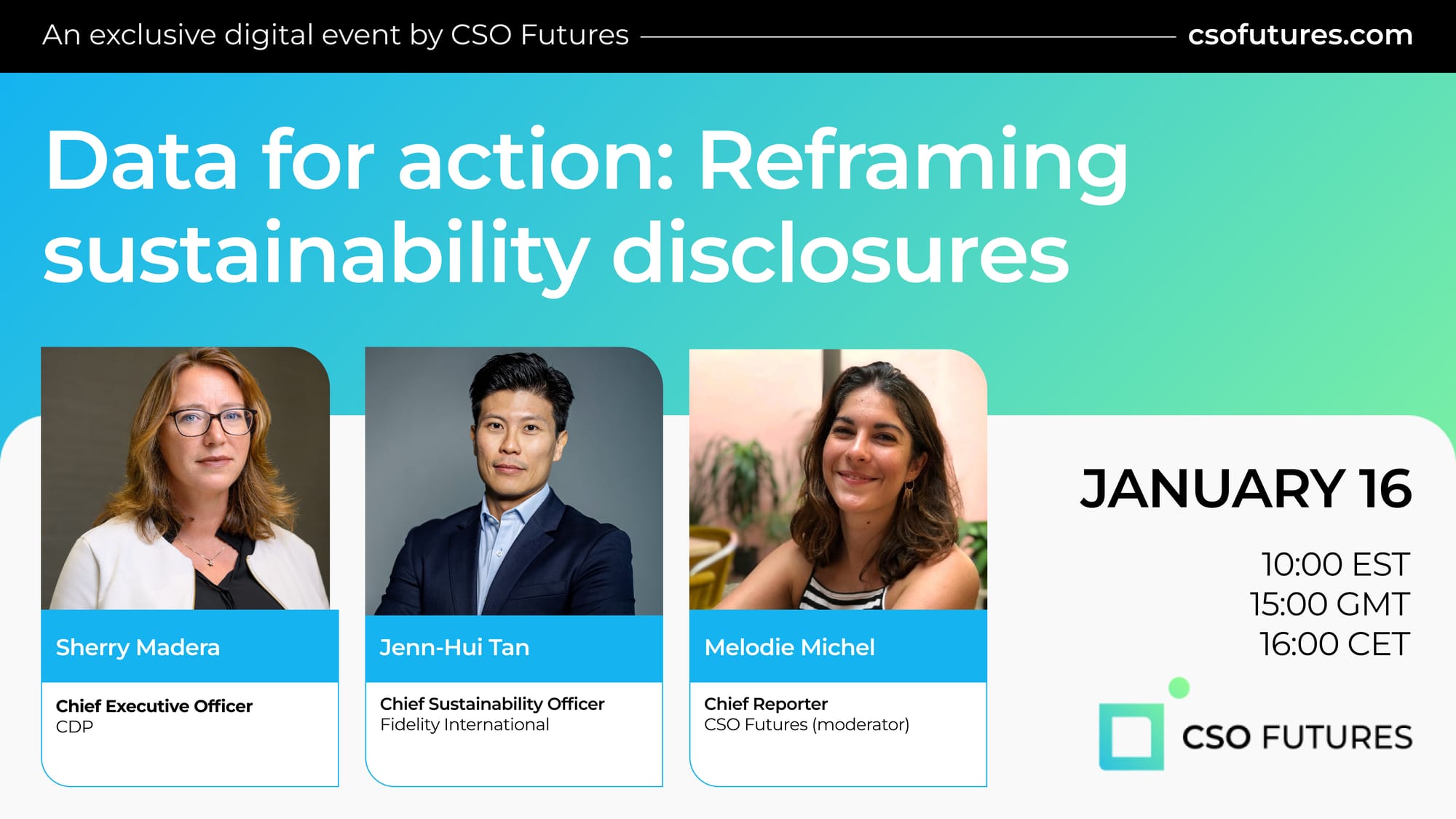

Data for action: Join our January 16 webinar on leveraging climate disclosures for growth

European banking watchdogs have been urging the sector to enhance ESG risk management processes for several years. At the end of 2023, the European Central Bank (ECB) began to take enforcement actions – including fines – against banks that did not conduct proper climate risk assessments.

Frank Elderson, Member of the Executive Board of the ECB and Vice-Chair of the Supervisory Board of the ECB, subsequently warned that “failing to plan is planning to fail” when it comes to the banking sector’s climate transition.

‘Failing to plan is planning to fail’

According to the EBA, the guidelines are meant to specify the content of plans to be prepared by institutions “with a view to monitoring and addressing the financial risks stemming from ESG factors, including those arising from the adjustment process towards the objective of achieving climate neutrality in the EU by 2050”.

These plans should be consistent with the transition plans prepared or disclosed by institutions under other pieces of EU legislation.

The EBA’s guidelines will apply from January 11, 2026, except for “small and non-complex institutions” for which they will apply at the latest from 11 January 2027.

Member discussion