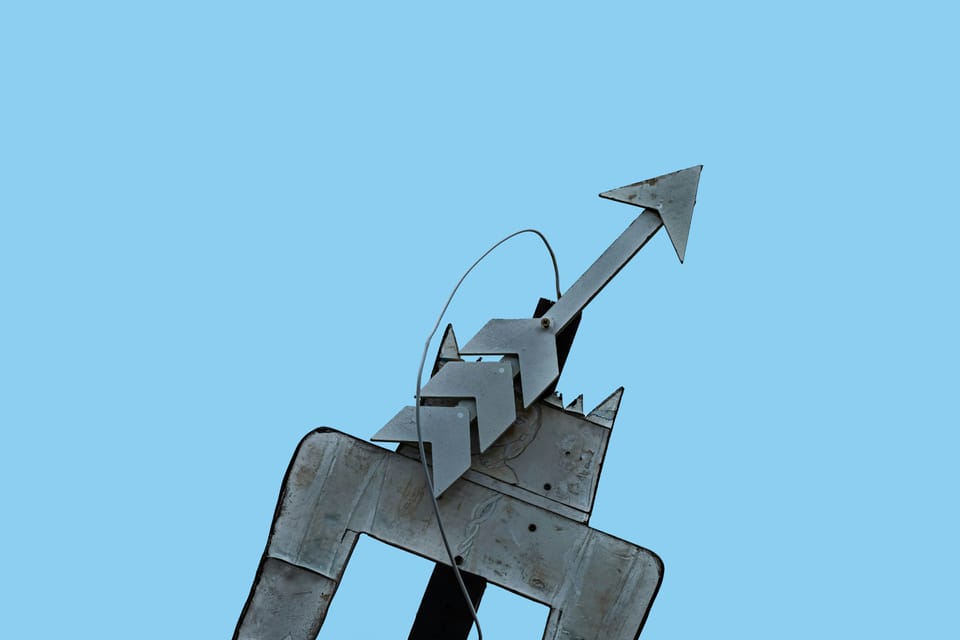

Institutional investors still hungry for sustainable assets

A wide majority of institutional investors around the globe expect their sustainable assets to increase over the next two years, according to a new survey.

The Morgan Stanley Institute for Sustainable Investing polled more than 900 institutional investors across North America, Europe and Asia Pacific this year, and found that 78% of asset managers and 80% of asset owners expect sustainable assets to increase over the next two years.

The trend is largely driven by client demand (with 80% of asset owners requiring their asset managers to have a sustainable investing policy or strategy in place) and targets, (with close to two-thirds of asset owners and managers having set a net zero target, and almost all saying they have a plan to deliver it).

It is expected to materialise in a combination of new mandates and higher allocations to sustainable funds from existing clients.

“Institutional investors see a growth trajectory for sustainable assets globally in the coming years to meet increasing client and stakeholder demands in a more mature sustainable investing market,” said Jessica Alsford, Chief Sustainability Officer and Chair of the Institute for Sustainable Investing at Morgan Stanley.

Defining sustainable investments

Interestingly, the types of sustainable assets that are popular among investors vary across regions. Globally, institutional investors tend to prioritise investments in healthcare (41%) and financial inclusion (40%), while in Europe, nature and biodiversity solutions rank higher than in other regions.

However, climate adaptation solutions are seen as one of the most “underappreciated investment opportunities across all regions”, says Morgan Stanley. This is a recurring issue in the sustainability world: at COP29, climate resilience initiatives garnered growing support, but limited funding pledges.

Read also: Climate resilience approaches (and budget considerations) for CSOs

Sustainability data remains a challenge

Unsurprisingly, two of the top reported obstacles to sustainable investing for both asset owners and managers in the survey is data availability (71%) and greenwashing (68%).

Additionally, 69% of respondents believe that “fluctuating regulatory guidance” is making it more difficult to invest in sustainable assets – something that is set to continue under Donald Trump’s second presidency in the US.

For investors in APAC, the burden of disclosure requirements for investors is also a particular concern.

Member discussion