European Commission proposes delays to parts of its flagship sustainability reporting rules

Updated 10:55 BST to correct that the delay is only for sectoral ESRS standards; proposal needs to be adopted and adds drop-down box with more details.

The European Commission has quietly proposed pushing sector-specific adoption of its European Sustainability Reporting Standards (ESRS) back by two years.

The proposed delay suggests that the first sector-specific ESRS submissions from non-EU companies exceeding the reporting threshold for will not be required until 2031* – as legal experts at Norton Rose Fulbright this week anticipated there would be “wide-ranging” consequences as a result of the move.

The EC quietly proposed the delay in the October 2023 publication of its 2024 Commission Work Programme – buying more time for organisations who will have to report some hugely detailed non-financial metrics to regulators when the sector-specific reporting standards become legally binding.

The EU Parliament and Council will now consider the Commission’s proposal "within the framework of the ordinary legislative procedure."

The EC said tersely that the move would result in “an immediate reduction in the reporting burden for in-scope companies” – under the proposed ESRS delay, adoption will start from 2026, rather than 2024, even for larger companies.

(A first set of ESRS was adopted by the Commission on 31 July 2023. It is now being scrutinised by the European Parliament and the Council. The first set is sector-agnostic. Sector-specific ESRS details

Article 29b(1), third subparagraph, of the Accounting Directive sets the adoption date of the sector specific ESRS by 30 June 2024. These ESRS are to specify the information that undertakings should report about sustainability matters and reporting areas specific to the sector in which an undertaking operates.

More details, please?

As part of its 2024 work program (and accompanying annex (“Annex“)) the EC says it is proposing "a 2-year delay of the date of adoption of the sector-specific ESRS, currently required in 2024. This also responds to a demand from the corporate sector.

"Postponing the adoption date by 2 years is relevant for companies in the scope of the CSRD, including listed SMEs, required to carry out sustainability reporting. This will allow these companies to focus on the implementation of the first set of ESRS adopted on 31 July 2023, ensure that EFRAG has time to develop sector specific ESRS that are efficient, and limit the reporting requirements to the minimum necessary.

"In addition, Article 40b of the Accounting Directive sets the adoption date for the ESRS to be used by certain non-EU companies with business in the Union by 30 June 2024. Considering that the reporting requirements for these non-EU companies only applies from financial year 2028, and considering the 2-year postponement of the deadline for adopting the sector-specific ESRS, the adoption deadline for these standards should also be postponed by 2 years. This will allow more resources to be dedicated to the development of effective and proportionate sector-specific ESRS, while still giving enough time for these non-EU companies to prepare ahead of financial year 2028."

The Annex also sets out the Commission’s intention to reduce the number of in-scope companies required to report under the CSRD/ESRS framework by adjusting current thresholds in the Accounting Directive. Law firm Herbert Smith Freehills shares more details here.

The decision comes as regulators and standards bodies try to achieve greater alignment and ensure common disclosures across reporting frameworks.

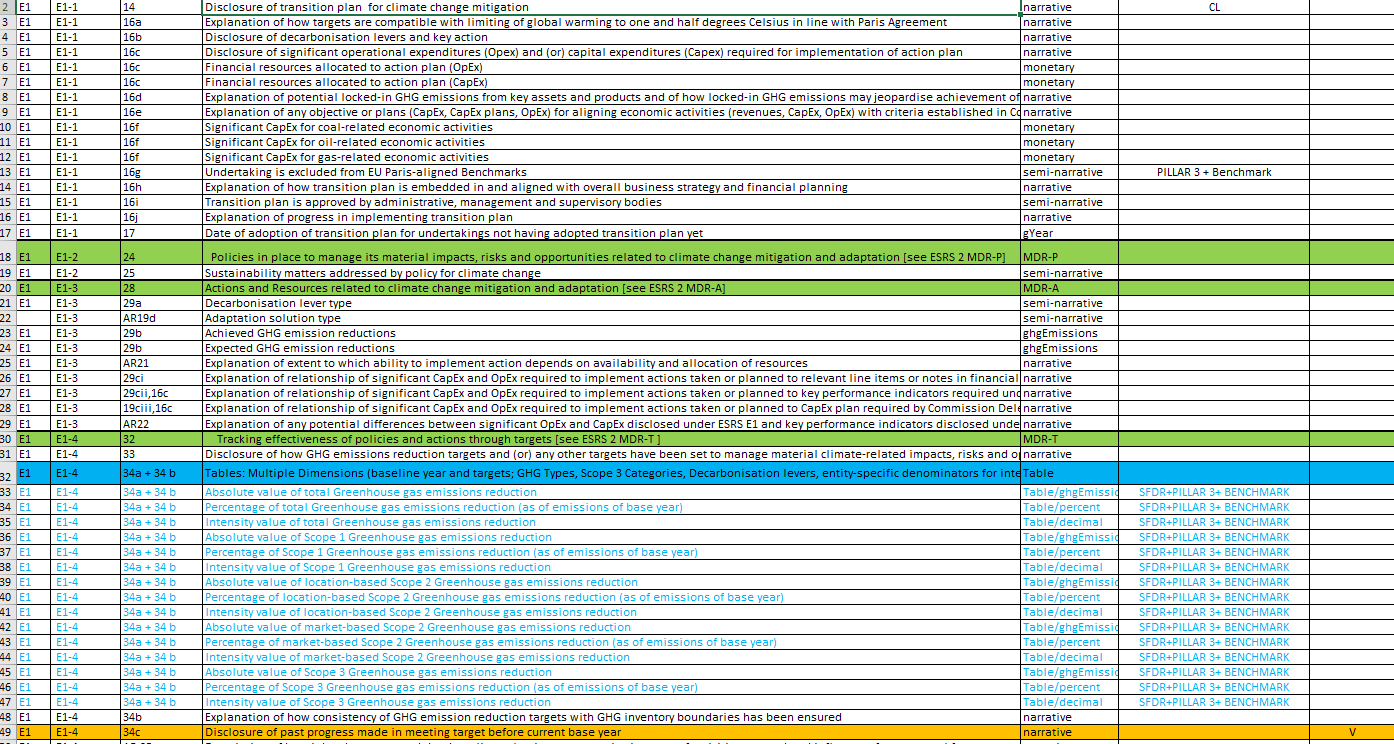

It also follows the October 25 publication by the organisation delivering the ESRS for the Commission of its “Draft List of ESRS data points: Implementation Guidance” [xlsx] – an Excel workbook containing a massive 1,178 data points.

ESRS delay: Stakeholders had warned...

The ESRS’s are part of Europe’s Corporate Sustainability Reporting Directive. The first batch of (likely onerous for the unprepared) reporting submissions under the ESRS has been due from companies by 2025. This will now be 2027.

The first set of ESRSs were delivered to the EC in November 2022. Stakeholders including the European Central Bank and the European Securities and Markets Authority (ESMA) both submitted pointed opinions on the standards in early 2023.

For those with a taste for jargon and very long sentences, an ECB staff opinion on the ESRS had captured some concerns, tidily, earlier this year. It warned that the “general requirements for materiality assessment would benefit from more granular and clearer guidance on the process to be followed by compilers; the use of estimates and the calculation of GHG emissions would benefit from further specification; the difference between the scope of consolidation under the CSRD and prudential consolidation may create challenges for the incorporation by reference of Pillar III disclosures as well as inconsistencies in relation to Taxonomy disclosures; a Legal Entity Identifier (LEI) requirement should be included in ESRS 2; [and] sector-specific intensity-based GHG emission metrics should be included in the sectoral standards to ensure alignment with Pillar III requirements.”

“A fast-moving reporting landscape”

As law firm Norton Rose Fulbright noted this week: “The CSRD is a significant part of a fast-moving global sustainability reporting landscape which is constantly evolving to harmonise the various regimes”; further changes may yet loom.

The rules are being delivered for the EC by the European Financial Reporting Advisory Group (EFRAG). In September 2023 it published a statement setting out the relationship between the CSRD and the International Sustainability Standards Board standards (IRFS 1 and IRFS 2) – which were published in June 2023, as stakeholders work to identify common disclosures between the ISSB and ESRS and those which are unique to each, to reduce reporting burden on companies.

As Norton Rose Fulbright put it in a blog this week: “Whilst the CSRD [ESRS] was introduced to meet the regulatory goals of the EU, and the ISSB standards created for investors to make better informed capital allocation decisions, they exist in tandem with one another and other sustainability reporting regimes.

“Changes to the implementation of the CSRD both in scope and timeline, will likely create ripples as other bodies pivot to reflect these shifts and preserve the much-discussed end goal: streamlined sustainability reporting for reduced duplication and uncertainty, and increased impact. The challenge for companies is to keep abreast of this fast-moving sustainability reporting landscape…”

For now, it appears, they will have several more years to do so.

Various CSRD reporting requirements will still be required.

The Big Four accounting firms on November 2 warned that neither corporates nor their investors are prepared for the reality that many companies will fail their CSRD reporting “assurance engagements” in the first few reporting cycles.

(Companies need “limited assurance” of their CSRD reporting – which the ESRS aims to add more detail to – from 2024 and “reasonable assurance” from 2028.

Deloitte, EY, KPMG and PwC told Responsible Investor that stakeholders are “not properly repared for the number of qualified opinions that are likely to be issued as companies undertake CSRD assurance for the first time” – a qualified opinion being consultancy-speak for where reporting contains omissions or material misstatements that mean the auditor lacks confidence in some of the reporting.

*Reporting for non-EU companies exceeding the specified turnover and subsidiary thresholds was to commence in the financial year 2028, with first reporting in 2029. With the two-year delay indicated by the EC, this would now by 2031.

Member discussion