Europe could be self-sufficient in battery cells by 2026 – if gigafactories don’t get cancelled

The continent’s recent policies have improved the outlook for European-made batteries, but over half of planned gigafactories remain at risk of being cancelled, according to a new report.

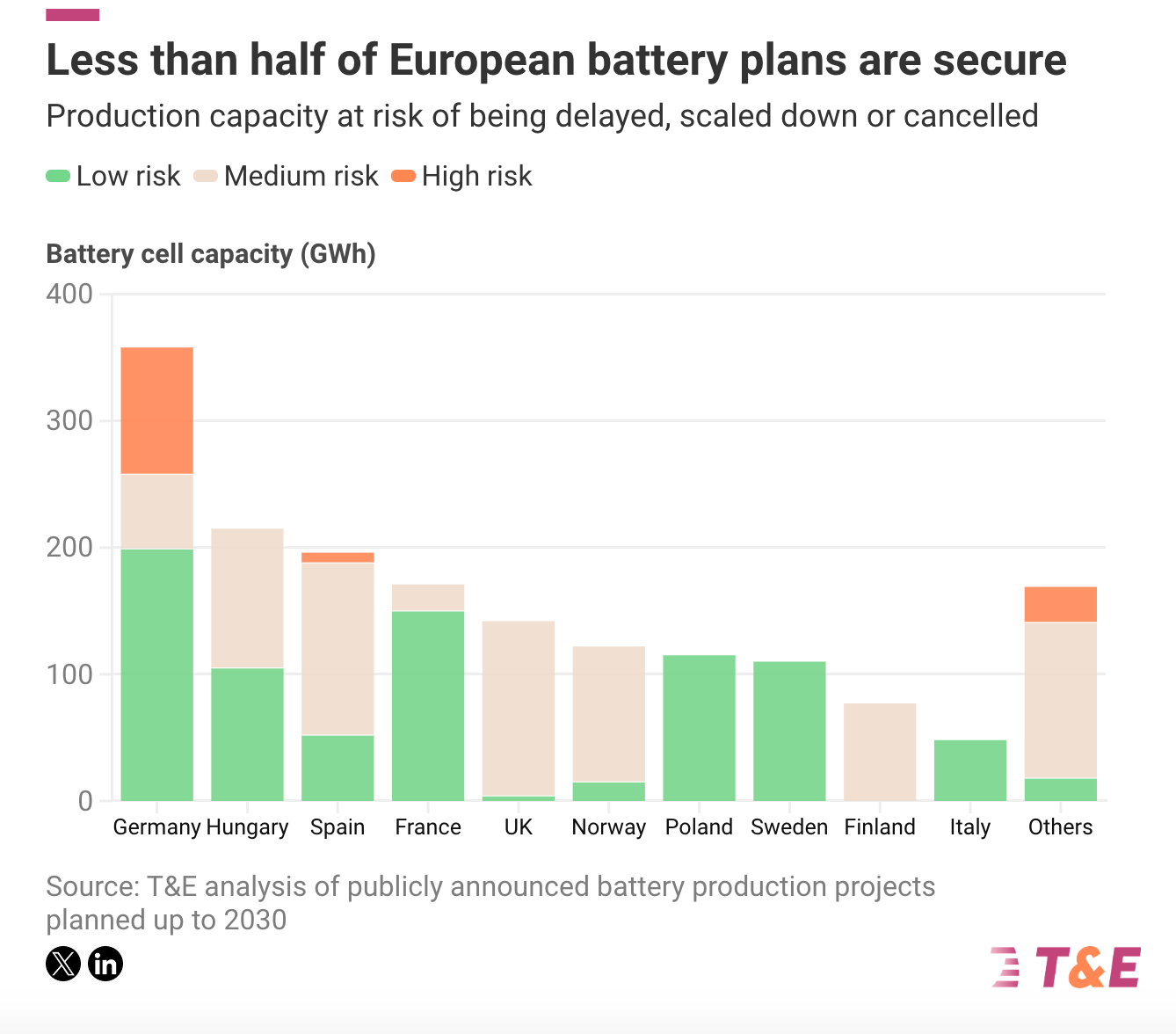

An analysis by NGO Transport & Environment (T&E) shows that, based on current factory plans, Europe could manufacture enough battery cells to meet its own demand as early as 2026. Between now and 2030, battery cell production capacity could reach 1.7 TWh, led by Germany, Hungary, Spain, France and the UK.

More than half of Europe’s planned battery cell capacity is at risk

However, just 815 GWh of this total (enough to power 13.6 million electric cars) is currently secure. More than half of planned battery plants are at risk of being delayed, scaled down or cancelled, as the race to capitalise on global EV demand means producers are being offered incentives in various geographies, including the US and China.

This is an improvement from last year’s assessment, when T&E estimated that two-thirds of the European planned capacity was at risk as subsidies from the Inflation Reduction Act were enticing producers to set up shop in the US instead.

Since then, Members of the European Parliament (MEPs) passed the Critical Raw Materials Act, which aims to reduce the EU’s dependency on foreign sources of battery minerals by setting quotas around EU-made battery consumption: at least 10% of materials should be locally extracted, 40% locally processed and 25% recycled within the bloc. Additionally, no more than 65% of the EU’s annual consumption of critical minerals should come from any single non-EU country.

Read also: Only three automakers aligned with 1.5ºC EV production needs

France, Germany and Hungary leading new battery developments

According to T&E, France, Germany and Hungary have made the most progress in securing gigafactory capacity since last year. In France, ACC, the joint venture between TotalEnergies, Stellantis and Mercedes-Benz, started operating its first gigafactory last May, with two others due to open their doors in Germany and Italy by 2026.

Another producer, Verkor, broke ground on its Dunkirk factory at the end of last year thanks to €659 million in support from the French government and up to €600 million from the European Investment Bank. The plant should start operations in 2025. And in Germany, Northvolt started the construction of its Schleswig-Holstein gigafactory in March 2024.

Hungary is set to be Europe’s number one battery cell producer by 2026 and has managed to secure more of its planned capacity over the past year – most of which is being developed by Asian companies.

“Across Europe, Finland, the UK, Norway and Spain, with projects by the Finnish Minerals Group, West Midlands Gigafactory, Freyr and Inobat, have the highest shares of capacity at high or medium risk,” adds T&E.

Leveraging Europe’s carbon rules to onshore battery production

According to the NGO, onshoring the battery supply chain to Europe would cut the emissions from producing batteries by 37%, compared to importing components from China. This is because Europe’s electricity grids tend to be cleaner than China’s, a country that still relies largely on coal.

As a result, local production in Europe could save an estimated 133 million tonnes of CO2 between 2024 and 2030 – equivalent to the total annual emissions of the Czech Republic.

And if the batteries were produced using renewable electricity, their carbon footprint would go down by more than 60%, notes the report.

Financial incentives needed

But none of this onshoring is possible without financial incentives, especially as the CAPEX and OPEX costs of building and running battery component facilities in Europe are some of the highest in the world. T&E estimates that developing all the announced plans for battery cell manufacturing, cathode and precursor facilities and lithium refining in Europe (including non-EU countries) will require €215 billion in CAPEX and €61 billion in annual OPEX, coming primarily from private investment. “If Europe aimed, for example, to match the operational support provided under the US IRA, it would need to provide around €2.6 billion in OPEX support on an annual basis alone,” says the NGO.

The US announced yesterday that it would quadruple tariffs on Chinese EV battery imports, to over 100%, in order to incentivise local production.

Julia Poliscanova, senior director for vehicles and e-mobility supply chains at T&E, said: “The battery race between China, Europe and the US is intensifying. While some battery investments that were at risk of being lured away by US subsidies have been saved since last year, close to half of planned production is still up for grabs. The EU needs to end any uncertainty over its engine phase-out and set corporate EV targets to assure gigafactory investors that they will have a guaranteed market for their product.”

Member discussion