China latest of 20+ jurisdictions to integrate ISSB standards into sustainability disclosures

With China’s draft sustainability disclosure standards published yesterday, more than 20 countries encompassing over half of the global economy have now integrated or plan to integrate the ISSB standards into mandatory sustainability disclosures for companies.

China is the latest country to announce its intention to make ISSB-aligned sustainability reporting mandatory, with a draft of its Corporate Sustainability Disclosure Standards published yesterday on the Ministry of Finance’s website.

The draft (in Chinese) includes six chapters and 33 articles covering general provisions, disclosure objectives and principles, information quality requirements, disclosure elements, other disclosure requirements, and supplementary provisions, and the government is now accepting feedback until June 24.

“The draft formulates the unified China Sustainability Disclosure Standards based on ISSB Standards, drawing on the beneficial experiences of ISSB Standards, aligning with China's context and showcasing Chinese characteristics,” explains the IFRS Foundation, which is behind the ISSB standards.

Once the rules are finalised, mandatory reporting will be phased in from 2027 starting with listed companies and gradually expanding to non-listed companies. China’s stock exchanges published their own draft guidelines for corporate sustainability disclosures in February.

More than half of the global economy on its way to adopt ISSB disclosures

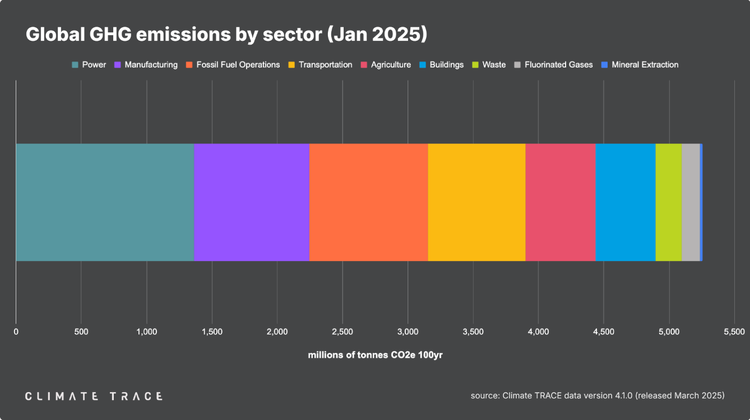

Jurisdictions representing nearly 55% of global GDP, more than 40% of global market capitalisation and more than half of global greenhouse gas emissions are now on a pathway to adopt the sustainability disclosure standards issued by the ISSB for mandatory reporting, according to the IFRS Foundation.

This update will be music to the ears of global investors, who recently urged policymakers to make ISSB-aligned sustainability reporting mandatory around the world by 2025.

Released in 2023, the sustainability reporting standards published by the International Sustainability Standards Board (ISSB), known as IFRS S1 and S2, are considered as a reference for voluntary reporting to investors.

Some of these jurisdictions are seeking (almost) full alignment with the ISSB standards: that’s the case of Brazil, Australia and the European Union, which just published interoperability guidance between ISSB and its own ESRS.

“From major economies to emerging markets, jurisdictions around the world such as Brazil, Costa Rica, Japan, Nigeria and the UK are recognising the value of the ISSB Standards. Supporting completion of their regulatory processes, as well as the engagement with other jurisdictions around the world, is our priority in the near future in creating the global baseline of proportionate, high-quality sustainability-related financial disclosures,” said ISSB Chair Emmanuel Faber.

In the US, the Securities and Exchange Commission (SEC) has acknowledged similarities between its contested climate disclosure rule and the ISSB Standards, though it specified that these cannot be used as an alternative for reporting.

IOSCO endorsement of ISSB sustainability disclosure standards

The growing popularity of ISSB standards IFRS S1 and S2 is in part the result of their endorsement by International Organisation of Securities Commissions (IOSCO): in July 2023 the organisation, whose members regulate companies in more than 95% of the world's financial markets, called on them to “consider ways in which they might adopt, apply or otherwise be informed by the ISSB Standards within the context of their jurisdictional arrangements”, in order to promote consistent and comparable climate and sustainability-related disclosures for investors.

Today at the IOSCO Annual Meeting in Athens, the IFRS Foundation released a guide to help jurisdictions design and plan their adoption or other use of ISSB standards, which acknowledges various ways in which countries may use the standards and describes different models from full adoption and partial adoption to permission to use.

“Today marks an important milestone in IOSCO’s objective to establish a global framework for comparable reliable sustainability disclosures for the capital markets. I am encouraged by the fact that not even a year after our endorsement and call to action, so many jurisdictions are seeking to adopt or be informed by the ISSB Standards. The ISSB’s Inaugural Jurisdictional Guide released today will be very useful to further support jurisdictional journeys towards adoption or use of the Standards and to bring much needed transparency to market participants on global progress,” said IOSCO Chair Jean-Paul Servais.

The IFRS Foundation also signed an agreement with the African Development Bank (AfDB) today in Nairobi to advance sustainability-related disclosure practices and capacity building on the continent

Member discussion