Businesses' direct GHG emissions will rise 11% in 2023 despite improved reporting

The direct greenhouse gas emissions of nearly 4,500 listed companies will rise 11% on average in 2023 – despite a clear uptick in target-setting and disclosures – as the UN flagged an “immense rift” between between the world’s “present trajectory and the path required to avert the most catastrophic impacts of climate change.”

Investment research firm MSCI’s Net-Zero Tracker, published Tuesday, analysed the reports of nearly 4,500 listed companies based in the G20 economies. It found that they will pump an estimated 12.4 gigatons (Gt) of GHG emissions into the atmosphere this year; double-digits percentage growth on their 2022 emissions.

To limit global warming to the 1.5°C target of the Paris Agreement, listed companies would need to cap future Scope 1 emissions at 33.4 Gt of CO2e by 2050. With no change to their current emissions, listed companies will deplete their remaining “emissions budget” in just 2 years, 8 months, the report found.

What about nation states?

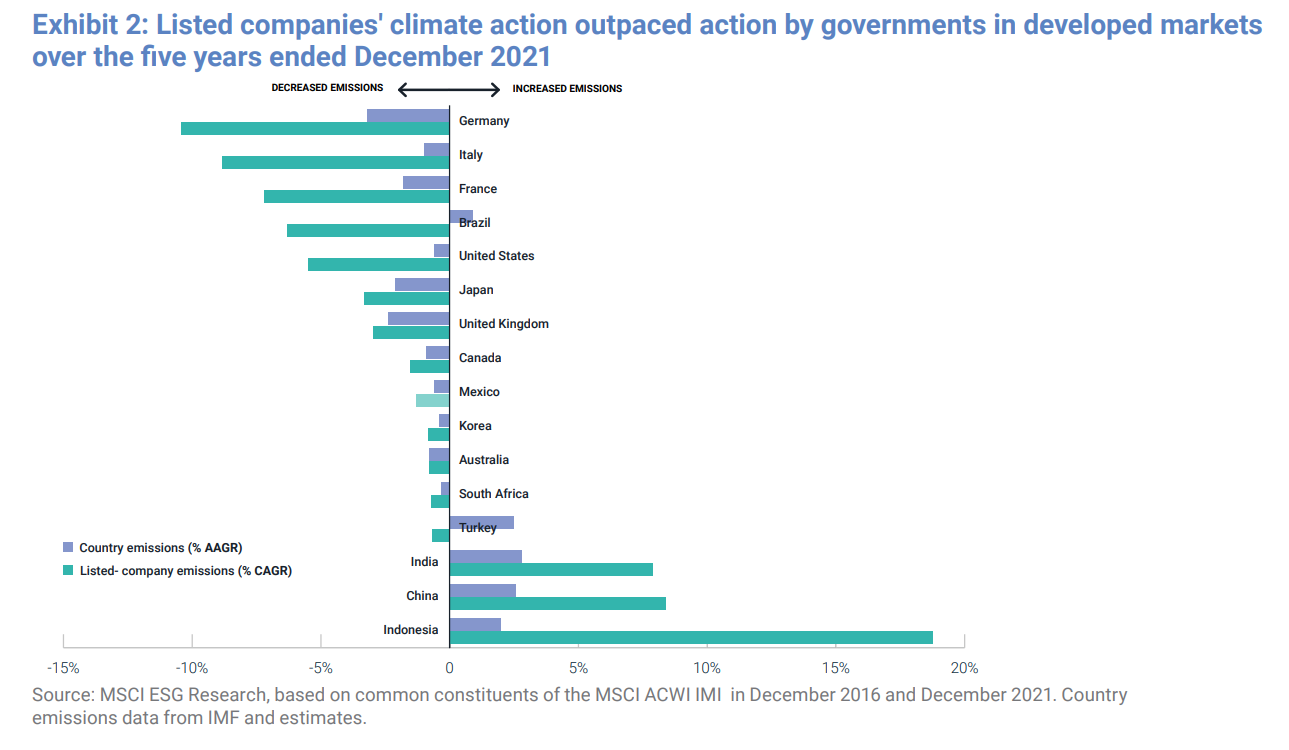

The report also flags a growing gap between emissions reductions performance in “developed-market” countries and three “emerging-market” countries.

In the majority of G20 economies, emissions fell over the five years that ended December 2021; with listed company emissions falling faster than country emissions. But in India, China and Indonesia, the converse was true: emissions rose, and rose faster among listed companies.

The report does not address to what extent this is the result of manufacturing etc. being relocated to “emerging-market” countries in the G20; but flags the (rather obvious) point that “delivering on climate commitments can make an outsized contribution to reducing global warming for emissions-intensive economies such as the U.S., China, Australia, Canada, Japan, Germany and South Korea…

The slowdown in private sector decarbonisation suggests, MSCI says, that the low-hanging fruit has been picked and greater challenges now need to be tackled that will require the removal of “structural barriers”, new tech and greater finance.

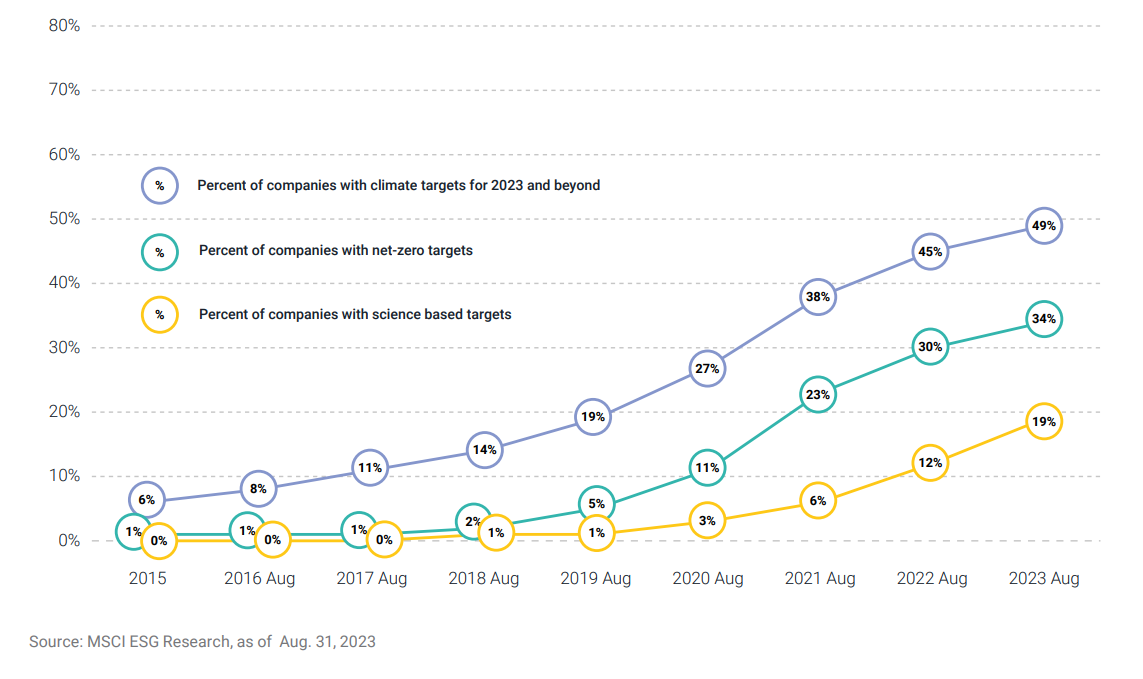

That’s despite positive progress on the number of companies setting emissions reduction targets: MSCI found that 34% of listed companies have now set a climate target that aspires to reach net-zero, up from 23% two years earlier. (The emissions of listed companies comprise roughly one-fifth of global emissions.)

Some 19% have published a science-based net-zero target that covers all financially relevant Scope 3 emissions, up from 6% over the same period; and 39% of have disclosed at least some of their Scope 3 emissions, up from 31% in 2022.

“Breakthroughs in decarbonising difficult-to-abate industries as well as the speed of transition to clean energy may play a larger role in private-sector decarbonisation” the report suggests, adding that “policy measures that can help to remove structural barriers to decarbonisation could also be critical to listed companies’ ability to deliver on their net-zero commitments” (a view echoed by many of CSO Futures’ recent Chief Sustainability Officer interviewees.)

Positive news for the CSOs trying to drive greater structural change, meanwhile.

A survey published this week found that 68% of Americans between the ages of 18-34 were willing to pay more for products from companies that have a strong stance on sustainability and climate change. More than half (52%) of those ages 35+ also agreed with this position – reflecting a “strong consensus people want corporations to take a proactive approach to climate action," according to Dan Lambe, CEO of the Arbor Day Foundation, which commissioned the survey.

Member discussion