Thinking green? Buy miners, BlackRock suggests to investors

“People pay premiums for companies that are lower carbon producers,” Olivia Markham, who manages BlackRock’s mining investments, said this week – as major institutional investors continue to point to a “green premium” or additional value for companies achieved by reducing their carbon footprint meaningfully.

That shift hints anew at the potential ROI for organisations of investing in and empowering a strong Chief Sustainability Officer with a mandate to help develop “sustainable competitive advantage” as well as meet regulatory responsibilities.

It comes as BlackRock’s Head of Thematic Investing Evy Hambro said that mining’s contribution to decarbonising the global economy has been “overlooked”.

In a new report for clients, “The Brown to Green Transition” shared with CSO Futures this week, BlackRock points to the growing demand for metals like copper as well as rare earths caused in part by an energy transition to renewables – and the investment gap when it comes to CapEx currently allocated to critical minerals.

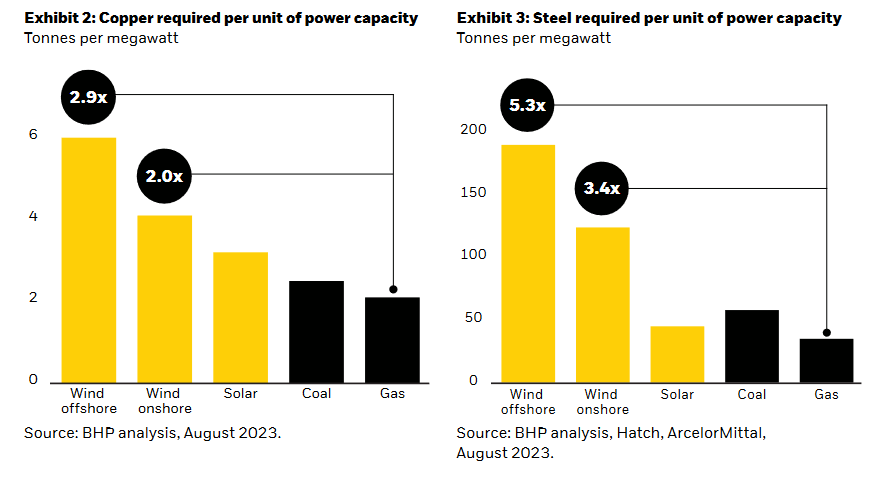

Despite that gap, more mining and metals production is coming, driven by a net zero transition ramping up demand for renewable energy and electric vehicles.

(Both require significant amounts of steel, rare earths, copper and more.)

The transition to a low-carbon economy is "requiring a substantial reallocation of resources as supply chains, production processes, and energy systems are reviewed. The global shift to reliable, low- emission energy is an opportunity that spans many asset classes and regions. While there are many aspects of the transition, we see one of the most important elements being the changeover from an energy system reliant on fossil fuels, to one based on metals and materials," as BlackRock puts it.

See also: Europe's largest iron ore miner seeks a Chief Sustainability Officer

“The cumulative capital expenditure required for critical minerals is expected to reach between US$360-450 billion by 2050. Astonishingly, over 60% of this estimated investment is earmarked for copper alone” said BlackRock, citing a “staggering gap” between this projected demand and current investments.

The IEA has found that the materials sector alone contributed to over 17% of the 36.8 billion tons of global greenhouse gas emissions in CO2 equivalent as of 2022.

BlackRock emphasises that “this share is expected to grow if deliberate action isn’t taken, particularly as the low-carbon transition increases the demand for metals and materials” – with countries like Germany, Sweden, and the Netherlands leading on potential solutions by “exploring zero-emission hydrogen-based solutions and direct electrification methods that extend from ore electrolysis in steel production to electric marine propulsion in the maritime sector.”

“Our view from speaking to our clients and investors at large is that the opportunity within this space has been massively overlooked,” Evy Hambro, global head of thematic and sector investing at BlackRock Inc., said in Bloomberg interview.

Mining companies are often excluded from ESG investment frameworks, but the sector’s contribution to decarbonising the global economy and its own efforts to cut emissions generated in the production of metals have been “overlooked”, adde Hambro, who co-manages the BlackRock World Mining Trust.

“Supply limitations coupled with surging demand could result in unanticipated increases in materials prices. Investors could stand to benefit by focusing on companies that navigate their carbon transition well, as they are likely to command higher valuation multiples than those that struggle with the transition” the report concludes.

Member discussion